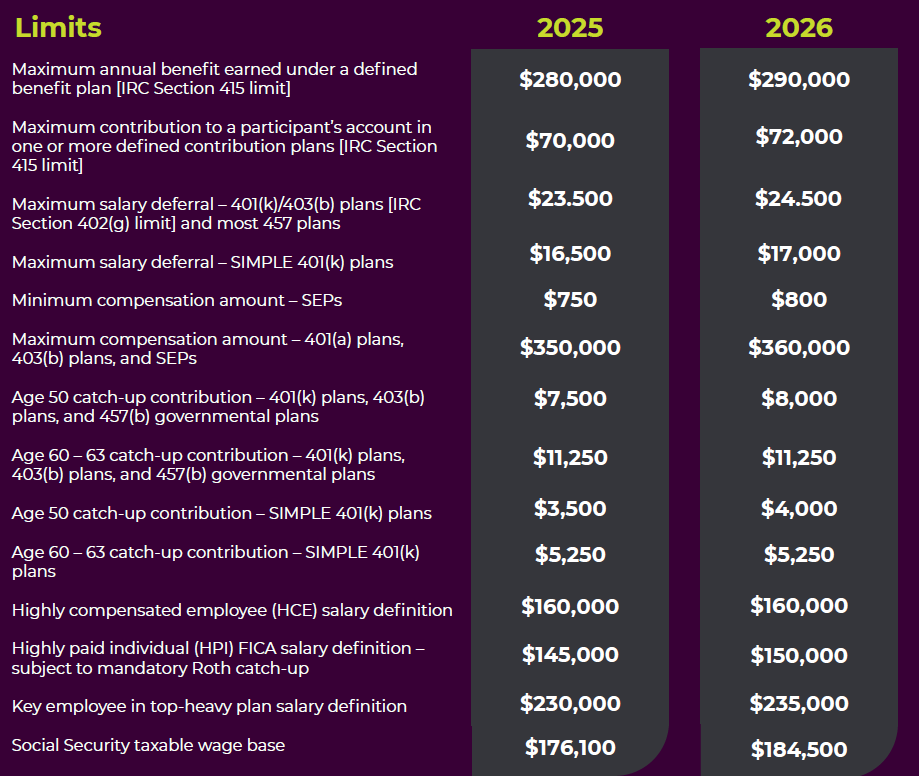

This information is for educational purposes only. We are not engaged in rendering legal, accounting, or other professional advice. If these services are required, an appropriate professional should be retained. This material is for your information, and we’re not soliciting any action based upon it, nor should it be construed as an offer to sell or as a solicitation of an offer to buy any security.

1The SECURE 2.0 Act of 2022 increases the catch-up limit for participants who attain age 60 – 63 during the calendar year. In the year the participant attains age 64, the limit returns to the age 50 catch-up limit. Check with your plan sponsor to see if this new catch-up limit is available in your plan.

2 The salary definition in the designated year determines the participant’s status as of the first day of the next year. For example, if a participant’s HCE salary exceeds the limit in the prior plan year, they are an HCE for the current plan year.

3 If a participant’s FICA wages exceed the HPI salary threshold in the previous calendar year, then they are an HPI for the current calendar year and must make age-based catch-up contributions as Roth for the current calendar year